Finance & Economics

Finance & EconomicsAnalysis of the Front National 2024 Program and Its Potential Impact on Financing the Energy Transition

Summary

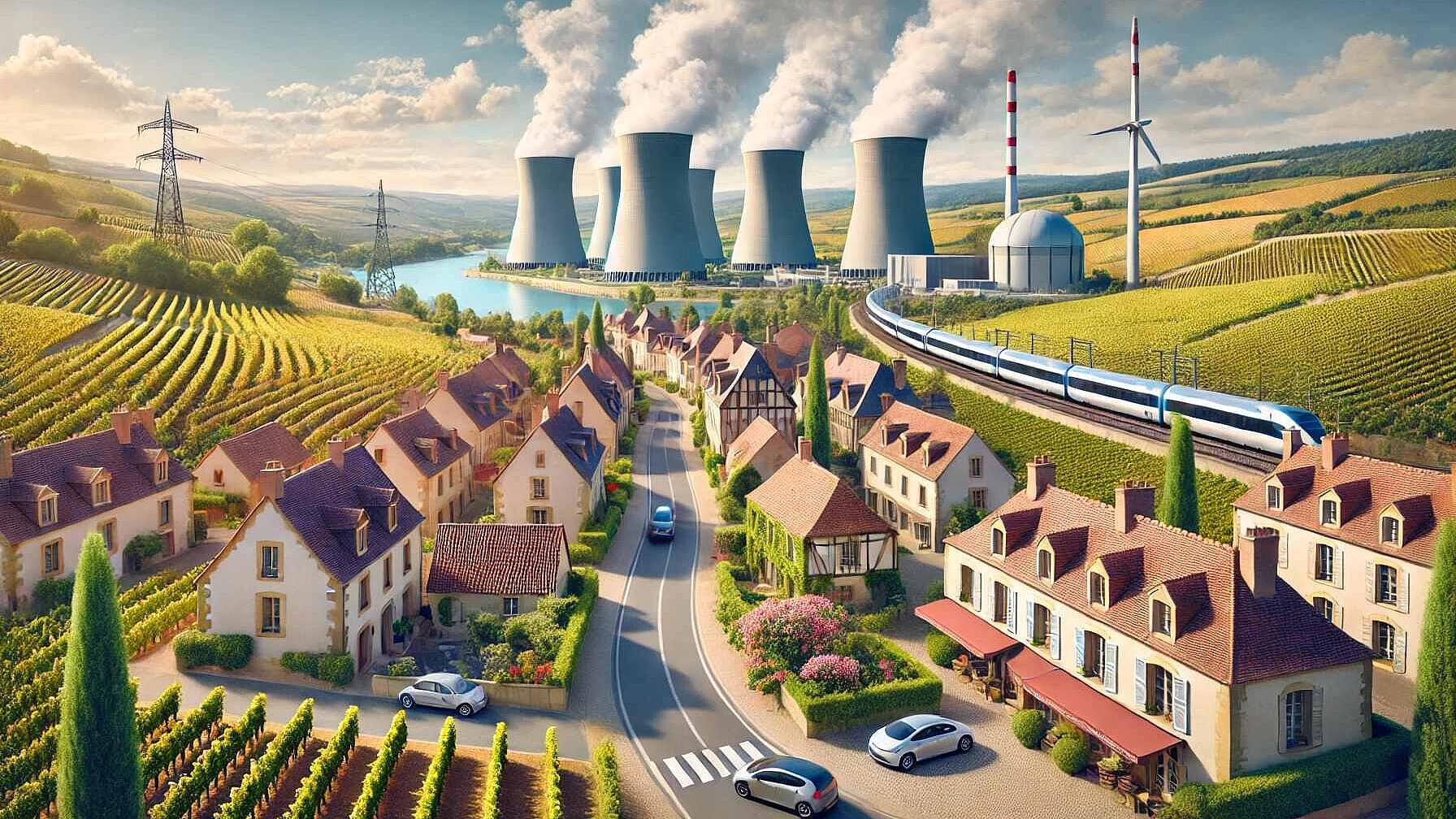

The Rassemblement National (RN) 2024 program advocates for national sovereignty and economic protectionism with reservations about the European Union, focusing on nuclear power and traditional energy sources over renewables. The program might reduce regulatory support for renewable energy, shifting subsidies to nuclear and fossil fuels, which could hamper the growth of renewable sectors and increase financing costs due to a less attractive investment environment.

Investor confidence might waver due to potential policy shifts and socio-political instability, while opportunities for public-private partnerships in renewable energy may decline. France's divergence from EU energy transition goals could create friction, affect its involvement in EU initiatives, and decrease collaboration on cross-border investments, influencing the EU energy market negatively.

In the short term (1-2 years), France may experience regulatory stagnation and an investment pivot towards traditional energies, hindering renewable energy ventures. Over the medium term (3-5 years), policy adjustments could occur if RN strategies result in setbacks, leading to a generally slower energy transition pace.

As for the EU, tensions could arise in the initial years, possibly reducing funding for France's renewable projects. In the medium term, France's policy divergence from EU green objectives might necessitate strategic realignments within the EU, impacting progress towards collective energy transition goals.

Overall, if the RN 2024 program is enacted, it's likely to have adverse effects on the funding and advancement of the energy transition in both France and the wider EU, increasing financing costs and creating a more challenging environment for achieving renewable energy goals.

Open full article

Analysis of the Front National 2024 Program and Its Potential Impact on Financing the Energy Transition

Overview of Front National 2024 Program

The Front National (now known as Rassemblement National, RN) 2024 program emphasizes national sovereignty, economic protectionism, and a cautious stance towards the European Union. Key points include reducing energy costs, increasing energy independence primarily through nuclear power, and a general skepticism towards renewable energy initiatives.

Impact on France

1. Regulatory Environment

- Nuclear and Traditional Energy Focus: The RN program prioritizes nuclear power and traditional energy sources. This focus may result in reduced regulatory support for renewable energy projects, slowing down the energy transition.

- Energy Independence: RN's emphasis on energy independence is likely to drive investments in domestic energy sources, particularly nuclear, potentially at the expense of renewable energy development.

2. Government Support and Subsidies

- Subsidy Shifts: There could be a shift in subsidies from renewable energy to nuclear and possibly fossil fuels. This reallocation may reduce the attractiveness of renewable energy projects for investors, increasing financing costs.

- Reduction in Green Incentives: The RN's economic policies might reduce financial incentives for green investments, impacting the growth of the renewable sector.

3. Investor Confidence

- Increased Uncertainty: The potential for policy reversals and a less favorable regulatory environment for renewable energy could increase uncertainty for investors. This might lead to higher risk premiums and financing costs.

- Political Stability Concerns: The RN's policies could lead to political and social unrest, affecting market stability and investor confidence in the energy sector.

4. Public-Private Partnerships (PPPs)

- Limited Collaboration: The RN's focus on national solutions may limit opportunities for public-private partnerships in renewable energy projects, further impacting investment levels in the sector.

Impact on the EU

1. Coordination with EU Policies

- Divergence from EU Energy Goals: An RN-led government may diverge from EU energy transition goals, creating friction and reducing France's involvement in EU-wide initiatives and funding for green projects.

- Impact on EU Green Finance Initiatives: The RN's nationalistic approach may reduce France's participation in EU green finance initiatives, affecting the overall financing landscape for energy transition projects within the EU.

2. Cross-Border Investments

- Decreased Cross-Border Collaboration: RN’s policies might discourage cross-border energy projects and investments, impacting the integration of the European energy market and slowing the renewable energy transition across the region.

- Investor Sentiment: Increased uncertainty and policy divergence introduced by an RN-led government could negatively affect investor sentiment towards the EU renewable energy market, leading to higher financing costs.

Outlook for the Next 5 Years

France

- Short-Term (1-2 Years):

- Regulatory Stagnation: Initial years might see regulatory stagnation or reversals in support for renewable energy, leading to reduced new investments.

- Increased Investment in Traditional Energy: There may be increased investments in nuclear and fossil fuel projects, aligning with RN’s energy independence goals.

- Medium-Term (3-5 Years):

- Potential Policy Adjustments: If RN policies lead to economic challenges or significant pushback, there might be some policy adjustments to rebalance energy investments.

- Slower Energy Transition: Overall, the energy transition in France is likely to slow down, with fewer new renewable projects and increased reliance on traditional energy sources.

EU

- Short-Term (1-2 Years):

- Tensions with EU: Initial years may see increased tensions between France and the EU on energy policy alignment, potentially impacting EU-wide energy projects.

- Decreased EU Funding for France: France may receive less EU funding for renewable energy projects due to misalignment with EU goals.

- Medium-Term (3-5 Years):

- Impact on EU Green Goals: France’s divergence from EU energy policies could slow down the overall progress towards EU-wide energy transition goals.

- Market Adjustments: Other EU countries may need to adjust their energy strategies to compensate for reduced collaboration with France, potentially leading to new alliances and investment patterns within the EU.

Conclusion

The RN's 2024 program, if implemented, could have significant negative impacts on financing the energy transition both in France and across the EU. Reduced support for renewable energy, increased focus on traditional energy sources, and potential misalignment with EU policies are likely to increase financing costs and slow down the energy transition. Over the next five years, these policies could lead to regulatory stagnation, decreased investor confidence, and potential economic and political adjustments in response to emerging challenges.

Sources:

- Rassemblement National 2024 Program

- Analysis of RN's Political Strategies Institut Montaigne