Energy Efficiency

Energy EfficiencyCost analysis of alternatives to natural gas in food, chemical and glass industries

Summary

Climact has identified the natural gas consumption hotspots in the EU industry.

Chemicals and food industry are the main consumers of natural gas in EU industry, responsible for 52% of its use. The key alternatives to natural gas for chemical and food sectors are heat pumps and electric boilers.

In glass making, electrodes can easily be incorporated in existing lines of productions, resulting in a hybrid furnace. This electric boosting makes a relatively implementable solution for gas reduction et short-term. Some actors (e.g. AGC) already begun to increase the share of electricity in their primary energy mix for production lines. They could benefit of substantial national subsidies for their capital investments.

You can read the report at the Climact website.

Open full article

Cost analysis of alternatives to natural gas in food, chemical and glass industries

The European natural gas market has been under tension for the last year in the context of the post-covid economic recovery and, lately, the war in Ukraine. This gave rise to growing awareness about the need for Europe to reduce its dependence on natural gas imports, particularly from Russia. Indeed, the total 155 bcm of natural gas imported from Russia accounted for around 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption. While this is a major challenge, it also represents an opportunity to accelerate the climate transition to a more efficient energy system fueled with cleaner energy.

In this context, Climact was asked to

(i) Identify the natural gas consumption hotspots in the EU industry

(ii) Investigate for these hotspots the best alternatives to natural gas in the short term, i.e. those that enable to quickly and significantly reduce the natural gas consumption, whether through process change, energy efficiency or fuel switch.

(iii) Assess the costs and benefits of these alternatives

Parts (i) and (ii) were addressed in a previous article, where 4 industry sectors were identified that collectively amount to two-thirds of the EU industry’s natural gas demand: the chemical sector (natural gas as an energy vector and as a feedstock), the food and drink industry, the glass and the ceramic sectors. The best short-term alternatives to natural gas for these 4 sectors and their natural gas use reduction potential were determined and it was estimated that around a quarter of current consumption could be reduced in the next 5 years.

Part (iii) assesses the costs and benefits of the best alternative (with the highest short-term reduction potential for natural gas use).

Here the main findings

Chemical and food industry

- Chemicals & food sectors have been identified as the main consumers of natural gas in EU industry, responsible for 52% of its use.

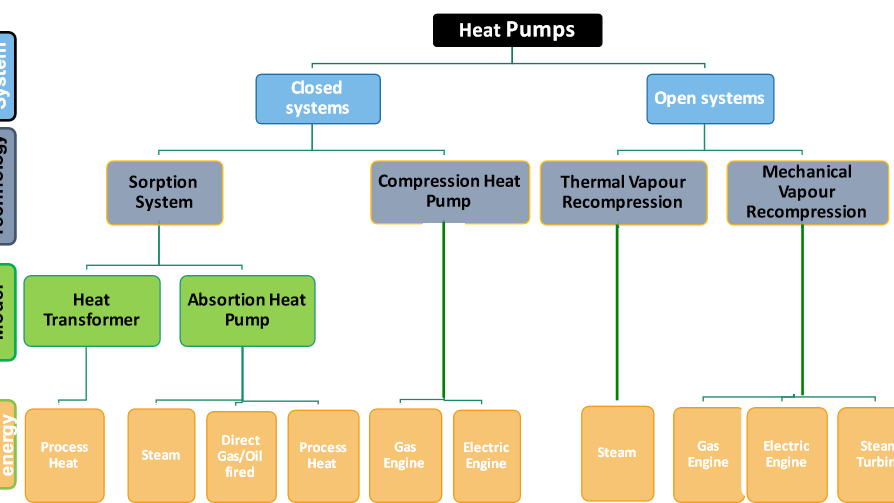

- The key alternatives to gas for chemical & food sectors are heat pumps and electric boilers.

- Electric boilers are similar to gas boilers in terms of investments but have higher operating costs for a common grid connection. Decentralized electricity generation (e.g. PV production) can potentially be a way to reduce the electricity bill compared to grid- based electricity.

- Heat pumps, especially high-T° ones, have high capital expenditures partially due to low market penetration and standardization. On average, a low-T° heat pump is 3 times more expensive (8 time for high-T°) than a gas boiler.

- Thanks to a higher energy performance, heat pumps consume about 4 times less primary energy than a boiler for the same useful output. It enables low and more resilient operational costs. Hence, for low-T° needs, replacing gas boilers by heat pumps is profitable after a few years, even if the gas boiler did not reach the end of its useful lifetime yet.

- There are various mechanisms and subsidies (EU and national levels) to support companies for such investments. These can help to make such investments profitable.

- The “worst-case” scenario of a consistently high energy price over the course of the decade renders heat pump comparatively more interesting than gas boiler due to their lesser primary energy consumption. Under such a scenario, high-T° heat pumps even become competitive with gas boilers.

- Numerous pilot projects on low-T° heat pumps have already demonstrated their economic viability. Investments in high-T° heat pumps projects need to be scaled, some large actors (e.g. BASF) are leading the way in this direction.

Glass industry

- Glass sector has been identified among large consumers of natural gas in EU industry, responsible for about 7% of its use.

- The key alternatives to gas for glass sector are full and hybrid electric furnaces.

- In glass making, electrodes can easily be incorporated in existing lines of productions, resulting in a hybrid furnace. This electric boosting makes a relatively implementable solution for gas reduction et short-term.

- Full electric furnaces can cause quality degradation (not a problem for container and fiber glass which makes up for most glass production) and are electricity intensive which requires a reliable power supply.

- There are various mechanisms and subsidies (EU and national levels) helping companies to invest and operate such assets.

- As there is no significant gain in energy efficiency, electric heating shows higher operating costs than gas heating. Nevertheless, to meet their climate targets, some actors (e.g. AGC) already begun to increase the share of electricity in their primary energy mix for production lines. They could benefit of substantial national subsidies for their capital investments.

You can read the full report at climact.com here