Finance & Economics

Finance & EconomicsFinance & Economics

Energy audits are becoming crucial for SMEs in managing energy consumption and cutting costs. These assessments detail a company's energy use, identifying efficiency improvements and savings opportunities, particularly valuable for SMEs with less resources than larger corporations. The European Investment Bank's data indicates that firms that have undergone an energy audit are 1.5 times more likely to invest in energy efficiency, with manufacturing and services sectors showing nearly double the likelihood. Smaller firms benefit disproportionately from energy audits as these audits impact their decision-making and investments significantly due to their higher relative energy costs and limited in-house energy management expertise. SMEs tend to adopt energy-efficient measures in support processes more than in production processes due to lower capital requirements and quicker returns. Additionally, innovative firms are more likely to implement recommendations from energy audits, improving their buildings and machinery quality standards. However, financial constraints can hinder the implementation despite the identified savings opportunities. Therefore, the availability of targeted financial resources for energy-efficiency investments is essential. In conclusion, energy audits are an essential step towards an energy-efficient business model for SMEs, enabling informed investment decisions, reducing costs, and contributing to sustainability, thereby shaping a more energy-efficient economy.

Leer Artigo completoEnergy Efficiency Or How SMEs Can Revolutionize Their Bottom Line

SMEs overlook 10-30% energy savings due to incomplete audits and complex consumption patterns. Adopting EMS offers cost reduction, improved productivity, regulatory compliance, and enhanced reputation. Barriers such as perceived costs, resource constraints, and lack of commitment hinder EMS implementation. Technology aids effective energy management, with smart meters and IoT enabling real-time data tracking. Best practices include starting with energy audits, setting reduction goals, and engaging employees. Successful EMS adoption in SMEs contributes to carbon emission reduction and energy transition goals, aligning with EU support for SME recovery and innovation.

Leer Artigo completoAnalysis of the Front National 2024 Program and Its Potential Impact on Financing the Energy Transition

The Rassemblement National's 2024 program prioritizes nationalistic policies, with an emphasis on nuclear power, potentially hindering renewable energy development. The program's focus on traditional energy sources may lead to regulatory changes, affecting investor confidence and France's alignment with EU goals. This could result in tensions with the EU, reduced funding, and a slowed energy transition.

Leer Artigo completoThe Economic Impact of AI on Energy Transition: Financial Institutions at the Forefront of a Green Revolution

AI accelerates the global energy transition by optimizing grid operation, predictive maintenance, and energy efficiency, advancing R&D, and enhancing energy trading strategies, attracting investment and job creation, with associated financial opportunities and risks.

Leer Artigo completoThe RetroMeter project: using metered energy savings to make energy efficiency more investable

This article discusses institutional investors' perspective on energy efficiency and how metered efficiency could spur investment. It addresses financial institutions' growing interest in energy efficiency due to market potential, risk mitigation, carbon emission reduction, and regulatory pressure. Barriers like small project scale, heterogeneity, data scarcity, and performance risk inhibit investment. The concept of metered efficiency, akin to Power Purchase Agreements, is presented as a solution to align payment with actual energy savings, enhancing investability and quality assurance in energy efficiency projects.

Leer Artigo completoAn overview of the ESCO industry

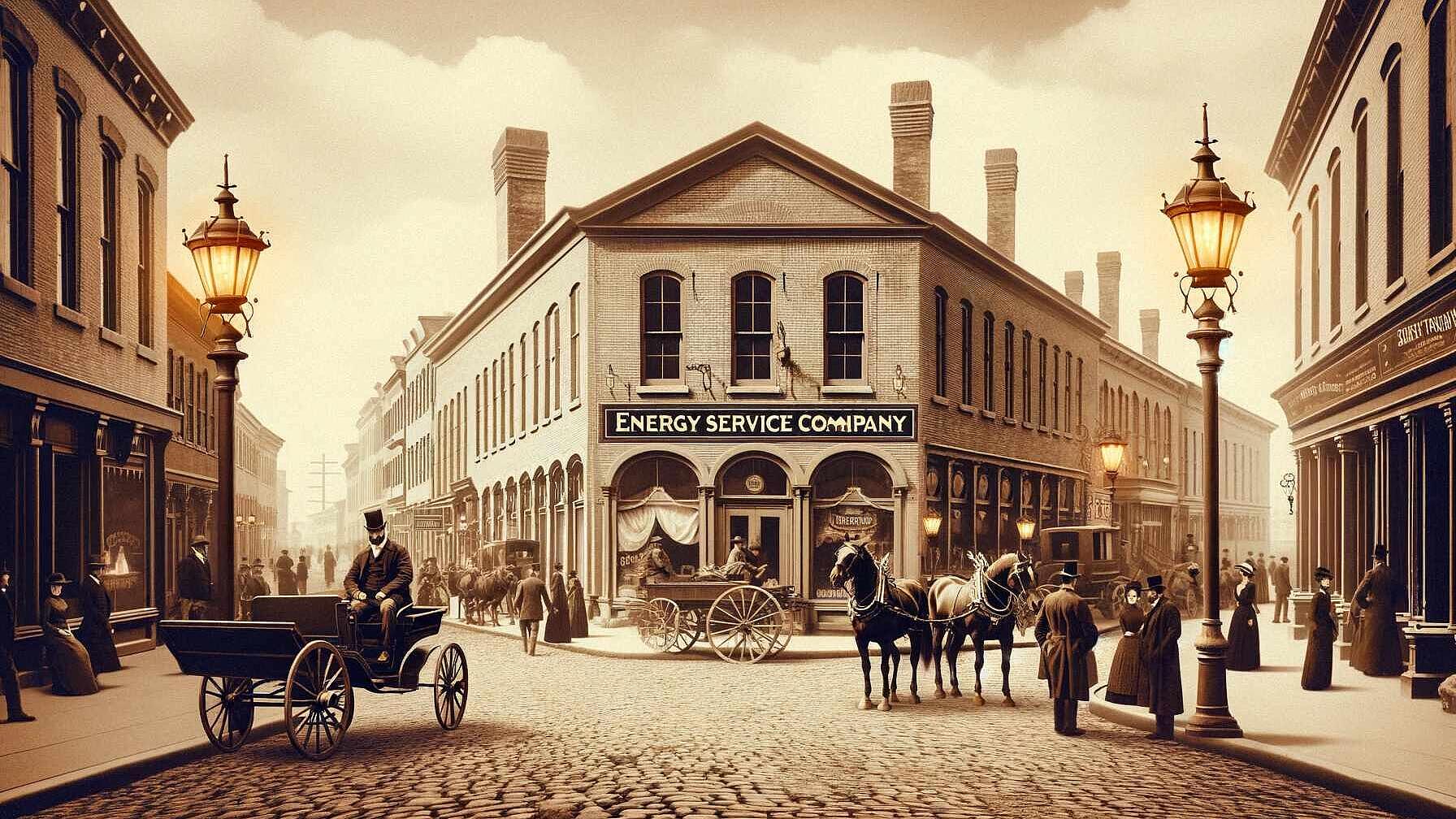

We need to triple global energy efficiency investment to meet COP28 goals. ESCO contracts can bridge the development gap by managing both technical and financial risks, fostering demand, and increasing financing capacity. Innovations like Super ESCOs, CaaS, LaaS, and standardized contract forms like EPCs can accelerate growth, but require policymakers, professionals, and financiers to align efforts for broad market scaling.

Leer Artigo completoEmpowering Small and Medium-sized Enterprises (SMEs) in the Energy Transition: The DEESME Project

The DEESME project, under EU's Horizon 2020, aids SMEs in energy efficiency endeavours, countering technical, financial, and awareness barriers. It provides a multi-layered approach to align SMEs with EU goals, offering policy recommendations and strategies to effectively implement Article 11 of the Energy Efficiency Directive.

Leer Artigo completoInnovative financial solutions to fight energy poverty

How social housing associations and EU projects are using innovative financial and solidarity mechanisms to combat energy poverty, emphasizing the dual benefit of social welfare and environmental sustainability through the refurbishment of buildings for energy efficiency.

Leer Artigo completoStimulating Consumer Demand for Energy Efficiency Investments

The Energy Efficiency Financial Institutions Group (EEFIG) will soon publish its final report from an expert working group on accelerating consumer demand.

Leer Artigo completoTransforming Europe’s Social Housing: Survey on Energy Efficient Refurbishment Strategies

SUPER-i survey is an online survey aimed at collecting insights on the current state of the energy-efficient refurbishment of social housing stocks in Europe. Results will identify areas for improvement, enable benchmarking of energy efficiency performance, and inform decision-making processes at various levels.

Leer Artigo completo