Energy Efficiency

Energy EfficiencyHEAT PUMPS IN THE EUROPEAN UNION 2022 - status report

Summary

There were 180 million heat pumps operational worldwide in 2020. That number needs to rise to 600 million by 2030 to be on track to meet a goal of net zero emissions by 2050. The EU is a recognised technology leader in heat pumps, especially in ground-source heat pumps and larger heat pumps for the commercial and district heating and cooling segments. There were around 16.8 million heating and hot water heat pumps installed by the end of 2021. There are a number of barriers that might slow the rate of growth, including a shortage of skilled installers and macroeconomic factors. Long-term market predictability based on a stable policy framework will be key to maintaining this trend. And the EU suppliers need to ramp up production to maintain their market share vis-à-vis third countries.

Open full article

HEAT PUMPS IN THE EUROPEAN UNION 2022 - status report

This report is an output of the Clean Energy Technology Observatory, which is being implemented by the European Commission’s Joint Research Centre on behalf of its DG Research and Innovation, in co-ordination with DG Energy. The scope is heat pumps for building applications, including large buildings and district heat networks.

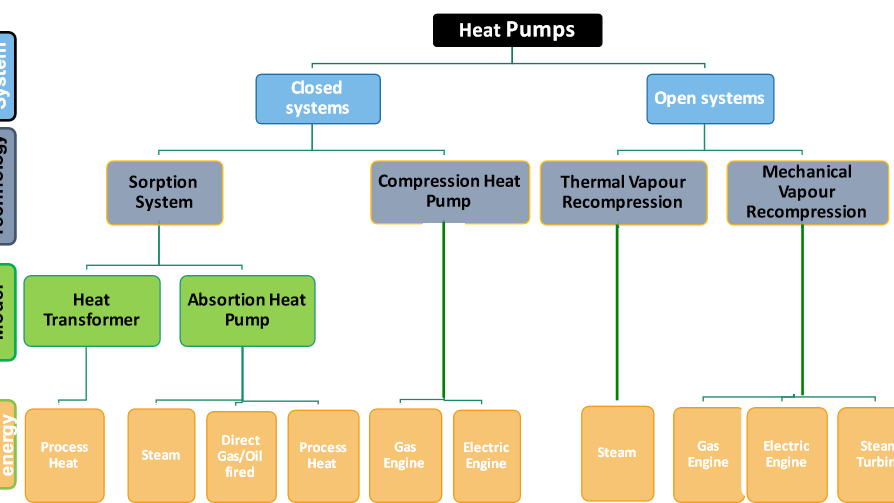

In the buildings context, heat pumps are used for heating, hot water, and in some cases also for cooling. The most common types use electricity and the refrigeration cycle to concentrate and move heat. Heat pumps are much more energy efficient than boilers; enable the greater use of renewable energy sources, ambient energy and waste heat; and can increase the flexibility of the entire energy system.

Focusing on those heat pumps that are used mainly for heating, there were 180 million units operational worldwide in 2020. That number needs to rise to 600 million by 2030 to be on track to meet a goal of net zero emissions by 2050.

In Europe, there were around 16.8 million heating and hot water heat pumps installed by the end of 2021. Sales bounced back from the pandemic year of 2020 to grow by around 34% in 2021, to 2.18 million.

REPowerEU envisages a doubling of the yearly pace of deployment, to install hydronic heat pump systems (those most likely to replace gas boilers) in an additional 10 million buildings in the next five years, and 30 million by 2030. If maintained, the average annual sales growth in Europe between 2019 and 2021 of all types of heat pump used for heating (20% per year) would achieve that target. However, there are a number of barriers that might slow the rate of growth, in particular a shortage of skilled installers and macroeconomic factors.

Such rapid deployment to 2030, and even more so to 2050, will require increased EU manufacturing of heat pumps and also some components. Significant investments in new and extended factories, as well as repurposing of existing production lines, are already in train, totalling at least EUR 3.3 billion to 2025. Longterm market predictability based on a stable policy framework will be key to maintaining this trend.

From the user perspective, the up-front investment in purchasing a heat pump is an important hurdle. However, the lifetime cost of a heating technology is dominated by the operating cost, which has been falling over time and is expected to continue to do so as the market grows and technologies develop. Moreover, heat pump owners can benefit from a premium on their property value.

The overall trend for public RD&I investment into heat pumps is increasing. Although amounts are small compared to some other energy technologies, the EU spends a significant amount on public research into heat pumps relative to some other countries around the world.

The EU is a recognised technology leader in heat pumps, especially in ground-source heat pumps and larger heat pumps for the commercial and district heating and cooling segments. This is also reflected in private investments, patenting trends and scientific publications.

Trends in turnover and employment are positive as well, with 318 800 direct and indirect jobs in 2020. The EU heat pumps sector is well established and highly innovative. It is well positioned to benefit from increasing deployment, and from market trends such as the reduction of environmental impacts through regulations on ecodesign and F-gases (hydrofluorocarbon refrigerant supply is dominated by China).

In 2020, the EU trade balance turned from a surplus to a deficit for the first time, mainly as a result of growth in imports, in particular from China. By 2021, the deficit had grown to EUR 390 million, from a surplus of EUR 202 million five years previously. EU suppliers need to ramp up production to maintain their market share vis-à-vis third countries, in a context of increased domestic demand.

Finally, heat pumps have few specific materials vulnerabilities. They are however vulnerable to broader trends such as volatility in metals prices and semiconductors supply.

Full report can be accessed here: setis.ec.europa.eu/heat-pumps-european-union_en