Finance & Economics

Finance & EconomicsFinance & Economics

The G20 energy efficiency work has not got much attention but there are some good things happening. At the event the group, with 15 participating countries chaired by France and Mexico, launched its G20 Energy Efficiency Toolkit. The toolkit offers a perspective on scaling up energy efficiency investments by defining and separating core EE investments - those stand-alone projects where energy savings are the main driver and integral investments where overall asset performance is the lead driver. It is a normal investment and a missed opportunity to include cost-effective energy efficiency measures. We need to change that through better regulation, capacity building amongst investors Banks and investors can help this process by building in checks and questions during their investment decision making. And we need to take actions to increase the rate energy efficiency we must take steps to increase efficiency. To scale up our energy efficiency, and actions to reduce customer risks by reducing customer risks and increase the deployment of capital into cost- effective efficiency opportunities within normal investments.

Read Full articleThe key to scaling up energy efficiency – new business models and structures

There are signs that the foundations of a functioning energy efficiency financing market are now being put in place. Investor Confidence Project is rolling out its Investor Ready Energy Efficiency™ project certification system in the US Europe, with growing interest from India, China .

Read Full articleWhere is industry in addressing Europe’s climate and energy obligations?

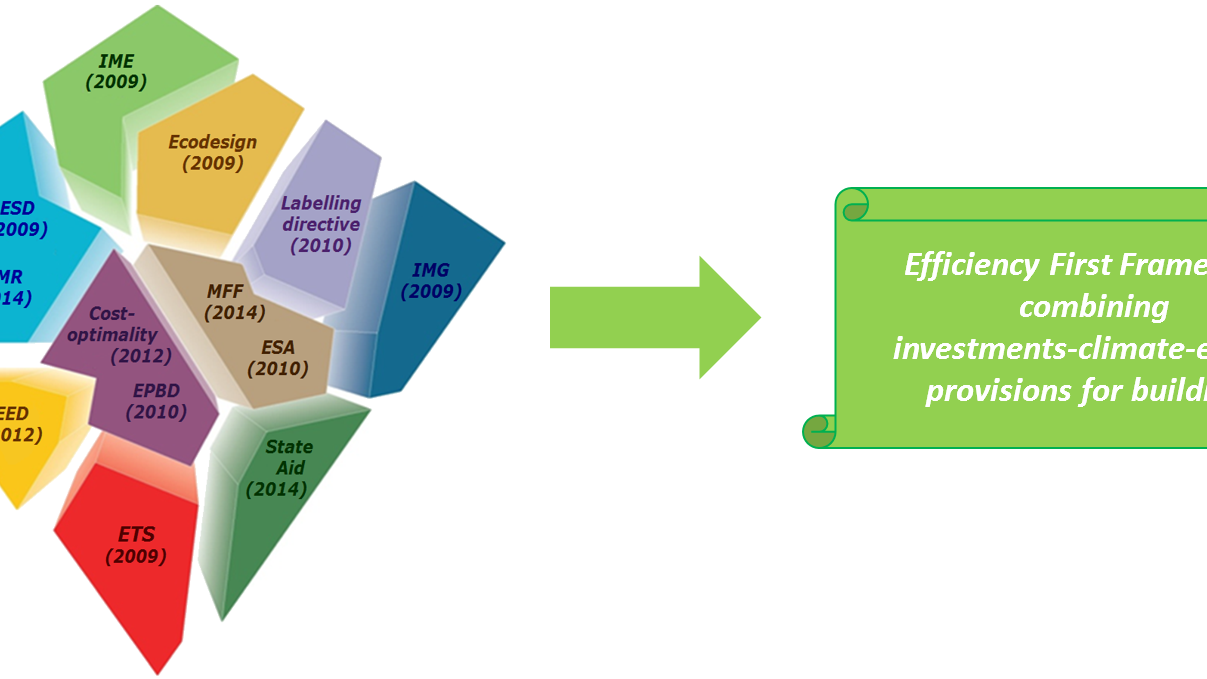

The European Commission published its proposals to revise its array of clean energy legislation. Informally, the proposals are known as the Winter Package. It proposed a new energy saving target for 2030 - 30%, up from 27% and now binding instead of indicative.

Read Full articleStandardisation, data and risk for energy efficiency investments

This morning I will talk about three important words for the energy efficiency finance market. They include standardisation, data and risk. ICP standardises the development and documentation process for energy efficiency projects. And we need to standardise performance data and reporting.

Read Full articleEnergy Transition of the EU Building Stock

Report estimates EU energy renovation market at EUR 109 billion in 2015 and 882,900 jobs. The size of the EU renovation market could increase by almost half if a 40% energy savings target is adopted for 2030. This would lead to more than one.

Read Full articleInvesting in Long-Life Renewable Energy and Energy Efficiency Assets

Investing in Long-Life Renewable Energy and Energy Efficiency assets is quite attractive for long-term investors. The paper reviews long-life asset-investments. Risk assessment must be one of the corner stones of every investment decision.

Read Full Business PracticeGreen Banking and Green Financing

SBI has over 20.000 bank branches in India and presence in 35 countries. SBI recognized as a front runner in Green Banking and Green Financing in India. Short paper covers different initiatives of SBI in areas of green banking and financing services.

Read Full Business PracticeFinancing Energy Efficiency: A Capital Market perspective

The money is there! --- this presentation covers the challenges for institutional investors, the framework for investment decisions and an example of energy efficiency project selection criteria.

Read Full Business Practice