Finance & Economics

Finance & EconomicsFinance & Economics

The Strategic Landscape of AI Infrastructure Financing: Microsoft, BlackRock, and Global Initiatives

The article discusses the escalating demand for artificial intelligence (AI) infrastructure driven by the technology's rapidly growing applications across industries. This surge in demand manifests in the increased need for massive computing resources and energy, prompting significant investments in building supportive infrastructures. The Global AI Infrastructure Investment Partnership (GAIIP) stands out, comprising a collaboration between Microsoft, BlackRock, Global Infrastructure Partners (GIP), MGX, and Nvidia to invest up to $30 billion in AI data centers, with the potential to expand to $100 billion through additional debt financing. This initiative aims to scale AI infrastructure primarily in the United States with provisions for global expansion. Other initiatives include Google's $75 million AI Opportunity Fund intended to improve AI infrastructure and India's $1.3 billion IndiaAI Mission aimed at developing AI capabilities with over 10,000 GPUs and support for AI startups. The European Union is also investing in AI infrastructure through the European AI Alliance, focusing on building infrastructures that comply with ethical and privacy standards. The challenge of ensuring environmental sustainability is significant given the large energy consumption of AI technologies. Initiatives, therefore, are incorporating investments in renewable energy sources. Emphasizing the beyond-single-entity scale of energy needs, industry leaders advocate for public-private collaborations to address both financial and environmental aspects of building AI infrastructure. Lastly, the article highlights the importance of global cooperation in building AI infrastructure, noting that robust infrastructure is key to supporting AI technology advancements and upholding environmental responsibility. Countries with strong AI infrastructure are likely to become leaders in the next phase of technological development, but this also raises questions of national security and economic competitiveness in the global landscape.

Read Full articleRevolutionizing Pump Systems: The Power of Life Cycle Cost Analysis

Pumping systems represent significant energy and cost usage in industrial operations. Implementing thorough Life Cycle Cost (LCC) analysis can yield major savings by encompassing all ownership costs from initial purchase to decommissioning. Proper design, avoiding oversizing, and maintenance are crucial strategies.

Read Full articleEnergy Efficiency Or How SMEs Can Revolutionize Their Bottom Line

SMEs overlook 10-30% energy savings due to incomplete audits and complex consumption patterns. Adopting EMS offers cost reduction, improved productivity, regulatory compliance, and enhanced reputation. Barriers such as perceived costs, resource constraints, and lack of commitment hinder EMS implementation. Technology aids effective energy management, with smart meters and IoT enabling real-time data tracking. Best practices include starting with energy audits, setting reduction goals, and engaging employees. Successful EMS adoption in SMEs contributes to carbon emission reduction and energy transition goals, aligning with EU support for SME recovery and innovation.

Read Full articleAnalysis of the Front National 2024 Program and Its Potential Impact on Financing the Energy Transition

The Rassemblement National's 2024 program prioritizes nationalistic policies, with an emphasis on nuclear power, potentially hindering renewable energy development. The program's focus on traditional energy sources may lead to regulatory changes, affecting investor confidence and France's alignment with EU goals. This could result in tensions with the EU, reduced funding, and a slowed energy transition.

Read Full articleThe Economic Impact of AI on Energy Transition: Financial Institutions at the Forefront of a Green Revolution

AI accelerates the global energy transition by optimizing grid operation, predictive maintenance, and energy efficiency, advancing R&D, and enhancing energy trading strategies, attracting investment and job creation, with associated financial opportunities and risks.

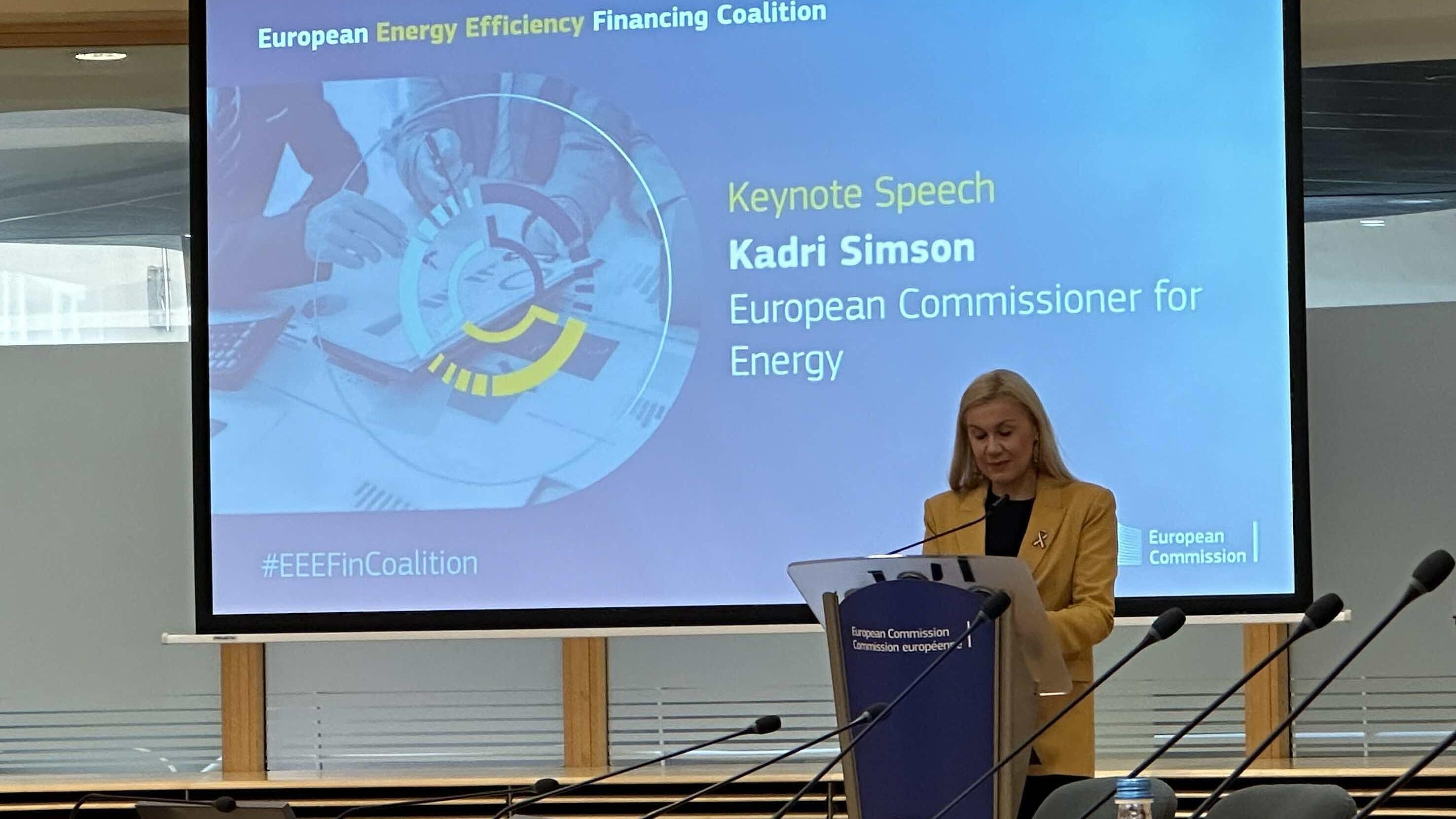

Read Full articleFinancing energy efficiency work continues: from EEFIG to EEEFinCoalition

The EEEFinCoalition launch aims to foster dialogue and improve the energy efficiency investment climate. It builds on EEFIG's work which enhanced commercial investment in energy-efficient technologies. EEFIG's final reports serve as key references for financing energy efficiency in buildings and industry, with a focus on consumer demand and regulatory frameworks. The EEIP extends EEFIG's efforts, particularly for SMEs, through projects like DEESME 2050.

Read Full articleThe RetroMeter project: using metered energy savings to make energy efficiency more investable

This article discusses institutional investors' perspective on energy efficiency and how metered efficiency could spur investment. It addresses financial institutions' growing interest in energy efficiency due to market potential, risk mitigation, carbon emission reduction, and regulatory pressure. Barriers like small project scale, heterogeneity, data scarcity, and performance risk inhibit investment. The concept of metered efficiency, akin to Power Purchase Agreements, is presented as a solution to align payment with actual energy savings, enhancing investability and quality assurance in energy efficiency projects.

Read Full articleAn overview of the ESCO industry

We need to triple global energy efficiency investment to meet COP28 goals. ESCO contracts can bridge the development gap by managing both technical and financial risks, fostering demand, and increasing financing capacity. Innovations like Super ESCOs, CaaS, LaaS, and standardized contract forms like EPCs can accelerate growth, but require policymakers, professionals, and financiers to align efforts for broad market scaling.

Read Full articleImpact and nature of the declaration on Energy Efficiency Financing

The EU Energy Efficiency Financing Declaration promotes energy efficiency as crucial for the EU's 2050 decarbonization, targeting a 11.7% increase by 2030. It urges substantial private investment for energy transition, aligning with the EU Green Deal, REPowerEU, and Paris Agreement goals, aiming for climate neutrality and economic resilience. The declaration establishes the European Energy Efficiency Financing Coalition to mobilize funding and outlines public sector leadership and investment conditions for energy efficiency projects.

Read Full articleJoint Declaration on the European Energy Efficiency Financing Coalition - Signed by Commission and all Member States

The European Energy Efficiency Financing Coalition was established through a Joint Declaration to mobilize private investment and create a robust funding framework for energy efficiency projects. The Coalition aims to bolster market environments and scale private funding to meet EU energy and climate targets.

Read Full article