Politica e regolamentazione

Politica e regolamentazioneThe 2025 Energy Pivot: Navigating Europe's New Compliance Landscape for Business

Sommario

Europe’s energy policy shift culminates in 2025, when major EU directives move from negotiation into national laws that create concrete compliance duties for businesses. The recast Energy Efficiency Directive turns “Energy Efficiency First” into a legal requirement and replaces size-based obligations with energy-consumption thresholds: firms above 10 TJ must conduct energy audits, and those above 85 TJ must implement energy management systems. In parallel, RED III raises the 2030 renewables target to 42.5% (aspiring to 45%) and tackles the biggest practical barrier—permitting—by introducing renewables acceleration areas with time-capped approvals and treating renewable projects as overriding public interest. Industry also faces binding requirements to increase renewable energy use by 1.6% annually, including uptake of RFNBOs such as green hydrogen. Looking beyond 2025, attention shifts to grid constraints and tougher 2040 climate targets.

Aprire articolo completo

The 2025 Energy Pivot: Navigating Europe's New Compliance Landscape for Business

From Ambition to Implementation

For European businesses, the energy landscape has shifted dramatically over the past five years. Driven by the dual pressures of the climate crisis—articulated through the "Fit for 55" package—and the geopolitical urgency of REPowerEU following the invasion of Ukraine, Brussels has aggressively retooled its regulatory framework.

While 2023 and 2024 were years of intense legislative negotiation, 2025 marks a critical turning point. It is the year where high-level directives translate into national law and tangible compliance requirements for enterprises. The era of voluntary targets and aspirational goals is rapidly fading. In its place is a rigorous, legally binding regime centered on two pillars: aggressive energy efficiency and accelerating renewable deployment.

For B2B leaders, understanding this shift is no longer just about corporate social responsibility (CSR); it is a fundamental matter of operational cost, legal compliance, and long-term competitiveness. This article analyzes how the policy environment has changed as we enter 2025 and looks ahead to the next phase of the EU's energy transition.

The New Paradigm: "Energy Efficiency First" Becomes Law

The most significant philosophical shift that hardened into policy leading into 2025 is the formalization of the "Energy Efficiency First" principle. Previously a guiding concept, the recast Energy Efficiency Directive (EED) (Directive (EU) 2023/1791) has given it legal teeth.

Before this recast, energy efficiency was often viewed by businesses as a cost-saving exercise to be balanced against other CAPEX priorities. The new framework requires energy efficiency to be considered in all relevant planning, policy, and major investment decisions related to energy systems. The EU has set a binding target to reduce final energy consumption at the EU level by 11.7% in 2030 (relative to 2020 projections).

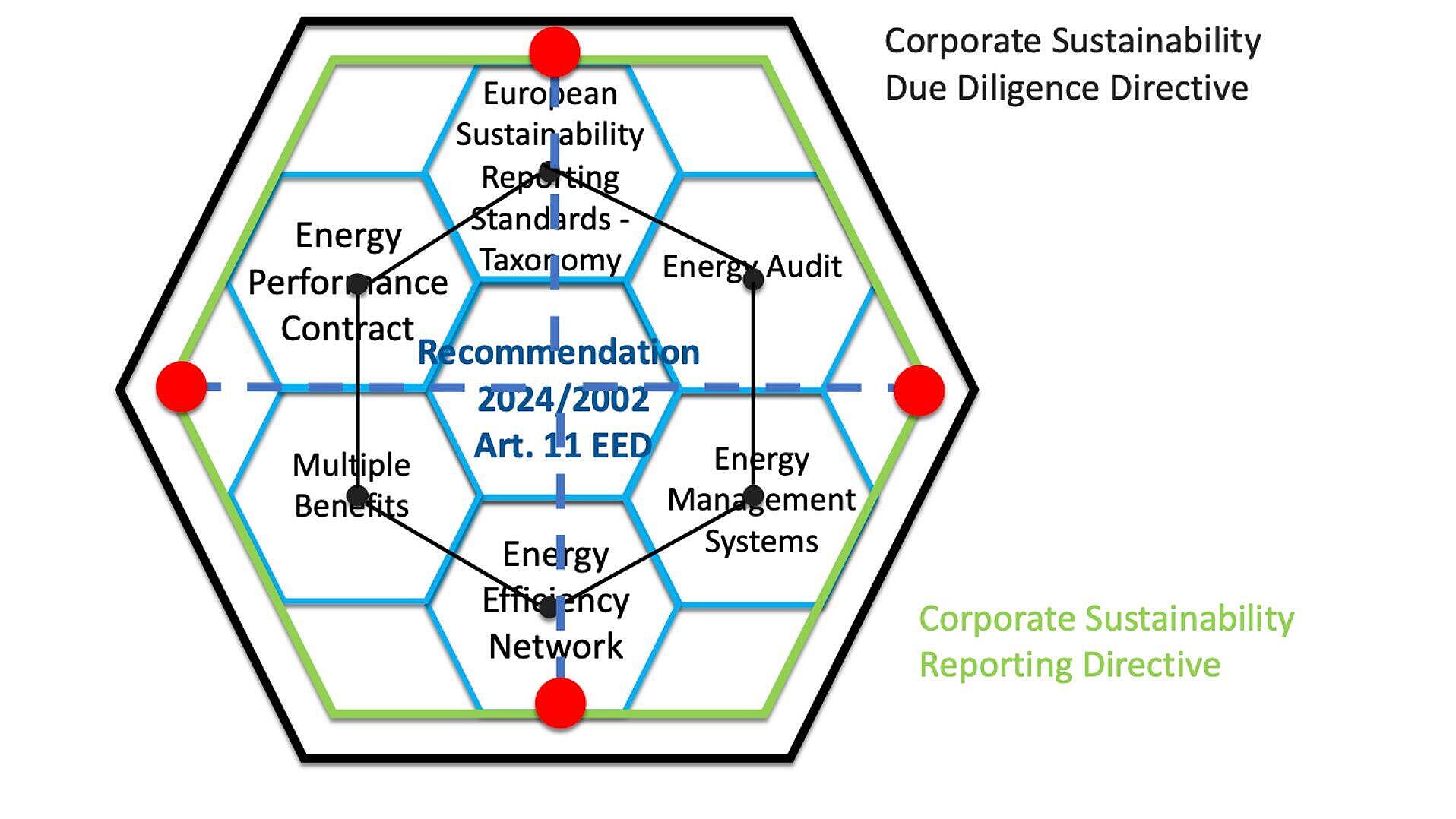

For large businesses, the immediate impact in 2025 is a change in auditing requirements. The old criteria based on company size (headcount and turnover) have been replaced by energy consumption thresholds. Enterprises with an average annual energy consumption exceeding 85 terajoules (TJ) over the previous three years must now implement an energy management system (EMS). Those exceeding 10TJ must carry out energy audits. This pulls many energy-intensive mid-sized companies into a stricter compliance net, forcing a structured approach to energy reduction that was previously optional.

The Renewable Acceleration: Removing Red Tape

Parallel to efficiency is the push for supply-side transformation under the revised Renewable Energy Directive (RED III) (Directive (EU) 2023/2413). The headline change is the increase of the overall EU renewable energy target for 2030 to a massive 42.5% (with an aspiration for 45%), up from the previous 32%.

However, for businesses attempting to deploy renewables—whether on-site solar for a factory or procuring wind energy via PPA—the most practical change impacting 2025 is permitting reform. The pre-2025 landscape was defined by agonizingly slow bureaucratic processes, where renewable projects could languish for 5-7 years in permitting limbo.

RED III has introduced the concept of "renewables acceleration areas" where permitting processes are streamlined and time-capped (e.g., one year for solar projects). Crucially, the deployment of renewables is now legally presumed to be of "overriding public interest." This introduces a powerful legal lever that businesses and developers can use to overcome local objections or administrative inertia that previously stalled projects.

Furthermore, RED III places specific, binding sub-targets on industry. By 2030, industry must increase its use of renewable energy by 1.6% annually. This includes specific mandates for the use of Renewable Fuels of Non-Biological Origin (RFNBOs)—primarily green hydrogen—in industrial processes, creating immediate demand signals for the emerging hydrogen economy.

The 2025 Defining Moment: Key Policy Shifts at a Glance

To understand the operational reality of 2025, it is helpful to contrast it with the regulatory environment of the recent past.

1. The Energy Efficiency Principle

- The "Before" State: "Energy Efficiency First" was largely a guiding concept or voluntary best practice.

- The 2025 Reality: It is now a legal obligation. The principle must be formally applied in planning, policy, and major investment decisions.

- Business Impact: Capital expenditure (CAPEX) requests for new energy infrastructure or retrofits will now face stricter scrutiny; approval will likely depend on demonstrating that efficiency solutions were prioritized over mere capacity expansion.

2. Corporate Energy Audits

- The "Before" State: Auditing requirements were based on enterprise size (e.g., headcount over 250), often leaving energy-intensive SMEs exempt while capturing low-energy large offices.

- The 2025 Reality: Requirements are now based strictly on energy consumption thresholds. Companies consuming over 10TJ must audit; those over 85TJ must implement an Energy Management System (EMS).

- Business Impact: The compliance net has widened to capture mid-sized manufacturing and logistics firms. The focus has shifted from "how big is the company" to "how intense is the energy use," requiring better data granularity.

3. Renewable Permitting

- The "Before" State: Projects faced agonizingly slow timelines (often 5+ years) due to bureaucratic inertia and "Not in my backyard" (NIMBY) objections.

- The 2025 Reality: Renewable deployment is now legally presumed to be of "overriding public interest." Designated "acceleration areas" impose strict time caps (e.g., 12 months) on permitting processes.

- Business Impact: On-site generation (like rooftop solar) can be deployed much faster, and Corporate Power Purchase Agreements (PPAs) become more viable as developer timelines stabilize.

4. Industrial Decarbonization

- The "Before" State: Decarbonization was primarily driven by carbon pricing (ETS) market signals and voluntary corporate sustainability goals.

- The 2025 Reality: The EU has introduced binding sectoral targets, requiring industry to increase renewable energy use by 1.6% annually.

- Business Impact: Industrial players face a mandatory shift toward electrification and the integration of Renewable Fuels of Non-Biological Origin (RFNBOs), such as green hydrogen, into their supply chains.

Looking Ahead: The Post-2025 Trajectory (2026-2028)

As businesses scramble to adapt to the 2025 reality, Brussels is already looking at the next horizon. The policy discussion for the next 2-3 years will likely move from setting targets to addressing the infrastructure bottlenecks preventing those targets from being met.

The overwhelming consensus in European policy circles is that the electricity grid is the new primary hurdle. The European Commission estimates that €584 billion in grid investments are needed by 2030 to accommodate electrification and intermittent renewables. We can expect significant policy activity, likely in the form of a "Grid Action Plan" or similar legislation, focused on interconnectivity, digitalization of the grid, and financing mechanisms for massive infrastructure upgrades between 2026 and 2028.

Furthermore, the debate over Europe's 2040 climate target is heating up. The European Scientific Advisory Board on Climate Change has recommended a 90-95% emissions reduction by 2040 (compared to 1990 levels). This suggests that the regulatory pressure will not ease after the 2030 targets are approached; instead, the trajectory will steepen toward near-total decarbonization within fifteen years.

Conclusion

The year 2025 is not just another year on the calendar for European energy policy; it is the point where the ambitious legislative packages of the early 2020s hit the ground. For B2B organizations, this signifies a move from strategic contemplation to operational necessity. The new frameworks for energy efficiency and renewables provide tools for cost control and security of supply, but they also impose new compliance burdens. The successful businesses of the next decade will be those that have internalized these changes today, viewing decarbonization not as a regulatory hurdle, but as the essential foundation of their future European operations.

Sources & Further Reading:

- European Commission:Energy Efficiency Directive (Recast)

- European Commission:Renewable Energy Directive (RED III)

- Official Journal of the EU:Directive (EU) 2023/1791 on energy efficiency

- Official Journal of the EU:Directive (EU) 2023/2413 as regards promotion of energy from renewable sources